By Scott Kriner, Green Metal Consulting

By Scott Kriner, Green Metal Consulting

Several years ago, a clever financing program was introduced to allow homeowners to lower their energy costs. The program was referred to as PACE – an acronym for Property Assessed Clean Energy. The first pilot programs took place in California around 2007. At that point it was accepted by 24 states in 24 months.

The principle behind how PACE works is that a homeowner can purchase products or systems to lower their energy cost, while the PACE financing pays for 100% of a project’s cost up-front. The loan is then repaid for up to 20 years with an assessment added to the property’s tax bill. PACE financing stays with the house if it is sold and is easy to share with renting tenants as well.

The improvements that are normally eligible for PACE financing include heating and ventilation systems, lighting, insulation, solar panels, and cool roofs. In some states water pumps, motors, water conservation, and hurricane and earthquake resilient strategies are also paid with PACE. However not all states or jurisdictions offer PACE financing.

|

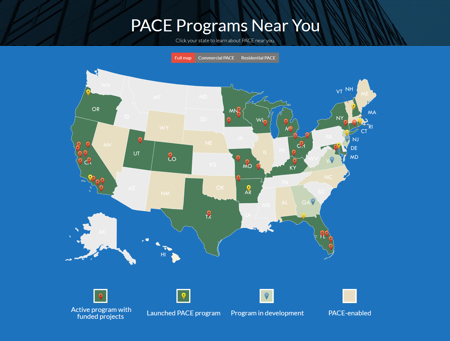

The PACE map helps commercial and residential customers locate participants in the PACE program. Click the map to view programs on the PACE website. |

In the early years of PACE it was only available in the residential market. But in July 2010 the U.S. Federal Housing Finance Agency (FHFA), which was created to oversee Fannie Mae and Freddie Mac, expressed serious concerns over the growth of PACE financing. The main concern by FSFA was that the added debt burden on a homeowner could increase the likelihood of a default on a mortgage payment. Soon after the ruling by FHFA the Department of Veterans Affairs (VA) and the U.S. Department of Housing and Urban Development (HUD) fell in line with Freddie and Fannie and then did not recognize PACE financing for energy efficiency improvements. And just as fast as PACE emerged in the market it was shut down for residential projects.

Soon the commercial market picked up the ball and began growing PACE financing in commercial , industrial and agricultural sectors. But even then, it has not been widely used in the commercial building market. Only 9 states currently have PACE programs.

The tide turned again when in August 2016, both HUD and the VA released new guidance which changed their positions to once again allow residential PACE financing. With the block from HUD, VA and FHFA removed, states and jurisdictions can now re-evaluate their former programs, and determine if new local or state legislation is needed. A map showing which states had PACE programs can be found at pacenation.us.

This now creates another tool for certain residential home owners who may have been considering purchasing cool metal roofing, or solar panels, and other energy saving improvements. Now those homeowners can purchase the energy-saving products and systems with the cost being paid back over 20 years with their property taxes.

Maybe it was an idea that was ahead of its time, but it’s time has now come back.