Taking Advantage Of The Section 179 Tax Benefit For New Rollforming Machines, Equipment, And More

|

Rick Zand

|

By Rick Zand, New Tech Machinery

As a business owner, it’s important to take advantage of every opportunity to save on taxes. Contractors and manufacturers who purchase new rollforming equipment may be eligible for a significant tax deduction on their machine by taking advantage

of Section 179 of the U.S. Internal Revenue Code, which offers substantial tax benefits for qualifying equipment purchases.

What is Section 179?

The idea behind Section 179 tax benefit is to encourage businesses to invest in their own growth. It serves as a direct incentive for small- to medium-sized operations to expand by acquiring new equipment and technology, thereby fueling not just their

growth but the broader economy, too.

Businesses can deduct the full cost of qualifying equipment from their gross income for the tax year, offering a substantial reduction in their annual tax burden. This, in turn, enhances cash flow and grants businesses increased purchasing power, allowing

for reinvestment in other areas or purchasing additional equipment, materials, promotional assets, etc.

Compared to a bonus depreciation write-off over several years, Section 179 allows you to take the full tax benefit as one write-off for the current tax year.

Eligibility Requirements

To qualify for Section 179, businesses must meet certain criteria:

Type of Business: Sole proprietors, partnerships, and corporations can all benefit from Section 179, including most businesses that pay taxes.

Profitability: Only profitable businesses can take full advantage of Section 179 since it’s a deduction that applies against profits. If you’ve purchased an $80,000 machine but only generated $50,000 in revenue for the year, you won’t

qualify. However, you can apply bonus depreciation.

Equipment Usage: The equipment must be used for business purposes more than 50% of the time to qualify for the deduction.

Acquisition: Purchased, leased, or financed equipment and software are eligible, provided they are used in the business by the end of the year.

Purchase or Lease: Only equipment purchased or leased and put into service during the tax year can qualify.

Qualifying Equipment for Section 179

A wide range of equipment qualifies for Section 179, which can include:

A wide range of equipment qualifies for Section 179, which can include:

Office Equipment: Desks, chairs, office equipment, signs, testing equipment, refrigerators, and other office or business collateral.

Machinery: Manufacturing tools, machinery, and equipment. This includes New Tech Machinery (NTM) portable rollformers.

Computers and Software: Purchased or financed software must be used for business purposes.

Business Vehicles: Certain limitations apply, but many types of vehicles used for business are eligible.

Property Improvements: Specific interior improvements to non-residential properties can qualify, including roofs, HVAC systems, fire alarms, and security systems, but they exclude building enlargements, elevators, and internal structural framework.

Note: Land, permanent structures, and certain other items are not eligible for Section 179 deductions.

Benefits of Section 179

Expensing the Entire Cost: Section 179 allows businesses to deduct the full purchase price of qualifying equipment in the year it is acquired rather than depreciating it over several years. This can provide a significant cash flow advantage by

reducing taxable income and tax liability.

Deduction Limit: For the tax year 2024, the deduction limit for Section 179 is $1,220,000. You can deduct up to $1,220,000 of qualifying equipment expenses from your taxable income.

Bonus Depreciation: Businesses can also take advantage of bonus depreciation once the Section 179 cap is reached,

so you’re not giving up anything by using Section 179. Businesses can deduct 100% of the cost of qualifying equipment that exceeds the Section 179 deduction limit on both new and used equipment.

Increased Expense Cap: The business equipment purchase cap for Section 179 has been increased to $3,050,000 for the tax year 2024. If your equipment purchases exceed this limit, the deduction available under Section 179 is reduced.

How Much of the Section 179 Tax Deduction Can I Claim?

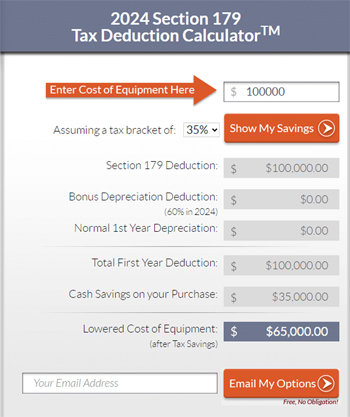

The amount of a Section 179 tax deduction you qualify for depends on your tax bracket. Let’s say yours is 35%. On the purchase of a $100,000 machine,

that’s a deduction of $35,000. In the end, you’ve only paid $65,000 for your machine! That makes a huge difference and is the reason every business owner should take advantage of applying for the Section 179 tax benefit and lower the cost

of their new equipment. To figure out your Section 179 tax deduction, use this calculator.

The amount of a Section 179 tax deduction you qualify for depends on your tax bracket. Let’s say yours is 35%. On the purchase of a $100,000 machine,

that’s a deduction of $35,000. In the end, you’ve only paid $65,000 for your machine! That makes a huge difference and is the reason every business owner should take advantage of applying for the Section 179 tax benefit and lower the cost

of their new equipment. To figure out your Section 179 tax deduction, use this calculator.

Section 179 tax benefits provide a valuable opportunity for businesses to save on taxes while investing in necessary equipment for operational growth. By taking advantage of the expensing provisions, businesses can optimize their cash flow and reduce

their tax liability. Understanding the eligibility requirements, benefits, deadlines, and qualifying equipment under Section 179 is crucial for maximizing savings and making informed equipment purchasing decisions.

The tax deduction can increase your profit margin by lessening the cost of the machine. Further, if you’re financing, it reduces the amount of interest you’ll pay by lowering the principle.

What’s the Best Time to Purchase a Machine?

As the eligibility is for the entire calendar year, we recommend purchasing early rather than waiting until the last quarter so you can have your equipment in use before the end-of-year cutoff date.

Note: As always, consult with a tax professional to ensure compliance with tax regulations and to take full advantage of Section 179 tax benefits. This article is meant to be informative but should not be used as advice for any specific situation

or circumstance that may vary between machine owners and their businesses. Please consult a tax professional to determine how Section 179 can benefit your business.

To view this complete article on New Tech Machinery's website, which includes a wealth of related information including videos, visit https://newtechmachinery.com/learning-center/section-179-tax-deduction-maximize-savings-on-a-portable-rollformer/.

About the author: Rick Zand taught English in the Middle East for nearly ten years. He has worked as a freelance writer, college professor, and university director of admissions. He’s currently the content specialist for marketing at New Tech Machinery, manufacturer of portable rollforming machines. He resides in Denver, Colorado.

About New Tech Machinery

New Tech Machinery manufactures portable rollforming machines used to form metal roof and wall panel profiles,

as well as seamless gutter profiles. For more information, visit https://newtechmachinery.com.

New Tech Machinery manufactures portable rollforming machines used to form metal roof and wall panel profiles,

as well as seamless gutter profiles. For more information, visit https://newtechmachinery.com.